Now that we have said farewell to yet another tumultuous year in the financial technology and staffing sectors, the question that looms large is whether the dawn of 2025 brings with it any glimmer of hope. Where can we find the optimism we so desperately crave? This time last year, there was a collective sigh of relief as we turned our backs on 2023, fervently wishing that the coming months would bring some respite from the challenges we faced. However, the reality was a continuation of the same struggles, rather like a recurring nightmare from which we couldn’t wake. Now, here we are again, hoping that the economic stagnation we’ve been grappling with will finally begin to subside. In retrospect, it seems we should have anticipated that 2024 would mirror its predecessor. With significant events like the elections in both the UK and the USA disrupting the economic landscape, a cautious "wait and see" approach to investment and hiring was inevitable. But with these hurdles now behind us, does it signal more activity and investment on the horizon? In short, the answer seems to be a cautious yes.

Before we delve deeper, let me make one thing clear—I am not a financial analyst nor an economist, and there’s a significant possibility that unforeseen variables could drastically alter the landscape in the coming year. However, having spent over two decades in recruitment and armed with insights from our own candidate survey, alongside reports from renowned sources like LinkedIn, Crunchbase, and the Staffing Industry Alliance (SIA), I find myself cautiously optimistic about what lies ahead.

In the UK, the situation is somewhat complex owing to the recent budget, which is perceived as somewhat hostile towards businesses due to the increase in minimum wage and national insurance contributions. However, Neil Carberry, the CEO of the UK’s Recruitment and Employment Confederation (REC), provides a counterpoint to this narrative. In a recent SIA article, he noted, "…the economy is bigger than policy, and the relative health of household balance sheets and growing confidence amongst employers in their own business can shift the scales in the other direction. With political stability and lower inflation, businesses are well-positioned to head into the jobs market and trading next year with more confidence.” This perspective suggests that despite the political and fiscal challenges, underlying economic factors could still fuel a recovery in business confidence, setting the stage for growth.

Across the Atlantic, the United States appears poised for a more significant upswing. The financial markets experienced a notable surge following Donald Trump's victory in the U.S. presidential election. Trump is widely regarded as a pro-business, pro-crypto, and fiercely pro-American leader, attributes that resonated powerfully with stock exchanges worldwide. This sentiment potentially lays the groundwork for a robust year in the U.S., with increased business confidence, inflation under control, and a semblance of political clarity.

Despite navigating a post-Covid rollercoaster, marked by extreme highs and stubborn lows, our sector continues to grapple with a pronounced skill shortage. Even with widespread tech layoffs and a notable increase in the number of job applicants, the reality remains that there are still more vacancies than qualified candidates. Our recent candidate survey underscores this, revealing that a significant majority of respondents (86%) are considering a job change within the next 12 months. This trend renders human resource planning a complex balancing act, as it’s likely that someone in your current team is already eyeing their next opportunity!

Despite navigating a post-Covid rollercoaster, marked by extreme highs and stubborn lows, our sector continues to grapple with a pronounced skill shortage. Even with widespread tech layoffs and a notable increase in the number of job applicants, the reality remains that there are still more vacancies than qualified candidates. Our recent candidate survey underscores this, revealing that a significant majority of respondents (86%) are considering a job change within the next 12 months. This trend renders human resource planning a complex balancing act, as it’s likely that someone in your current team is already eyeing their next opportunity!

The staffing challenges we face are not solely restricted to filling vacancies. The rapid pace of technological innovation means that businesses must also consider reskilling or upskilling their workforce to stay competitive. This is particularly true in the financial technology sector, where developments in artificial intelligence, blockchain, and cybersecurity are reshaping the industry at breakneck speed. Companies that invest in the professional development of their employees stand to gain a competitive advantage, not only in attracting top talent but also in retaining it.

Moreover, the importance of diversity and inclusion in the workplace cannot be overstated. As we move forward, organisations that prioritise creating an inclusive environment will likely find themselves better equipped to navigate the challenges ahead. A diverse workforce brings a variety of perspectives and ideas, which can lead to more innovative solutions and improved business outcomes.

But where has the best talent pool? The USA and the UK still dominate the fintech scene, and whilst Asia Pacific is projected to challenge sometime in the next decade, it’s really America that sets the pace. Whilst the last 18-24 months have seen increased resistance to the ideals of hybrid and remote working, and many sectors have seen a drive to return employees to the office, the companies that can offer a less dogmatic approach still retain the highest likelihood of being in a position to secure the best talent.

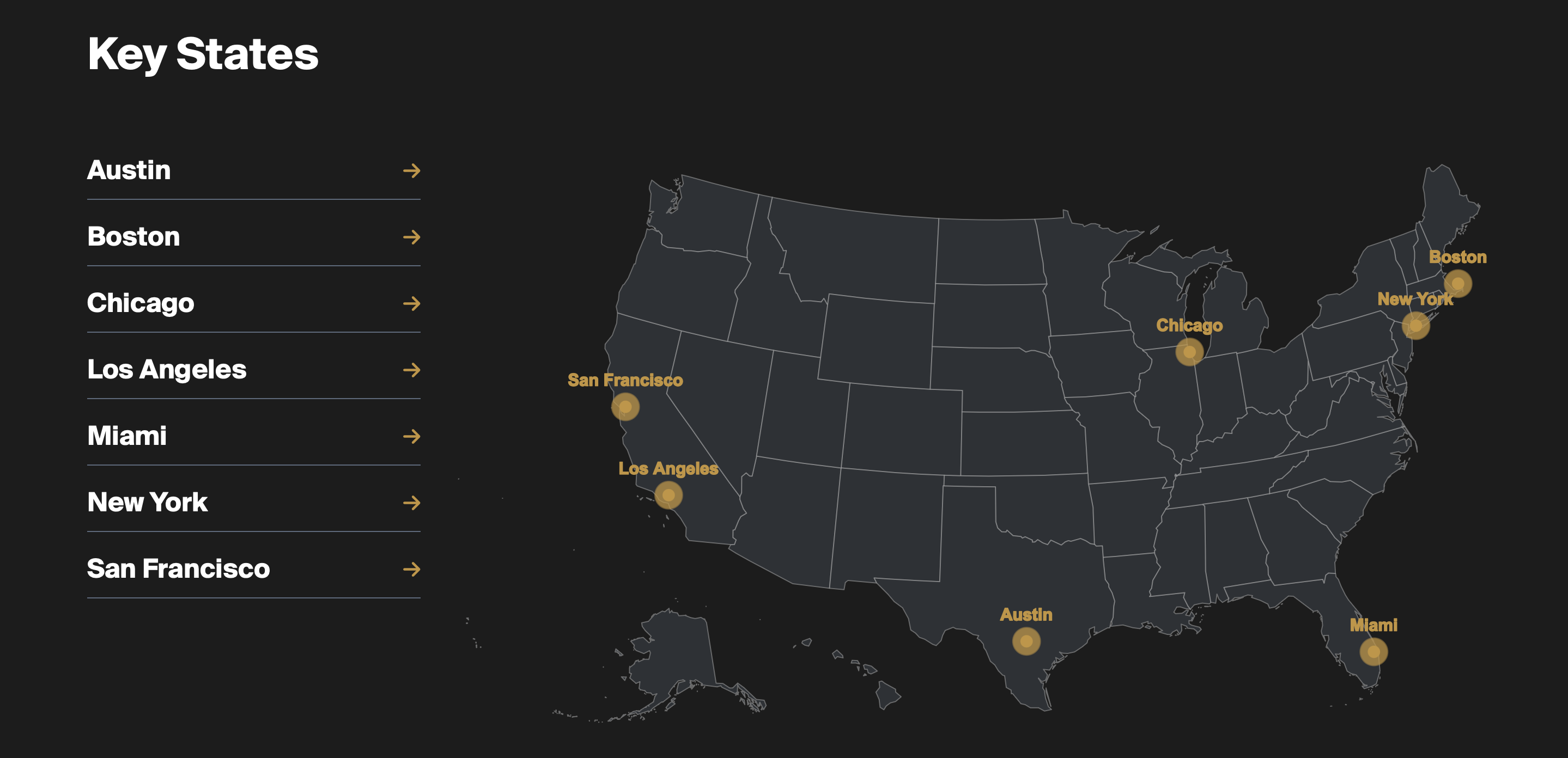

The USA has several cities that immediately come to mind when people think of financial technology, and standing proudest amongst them all is the undisputed epicentre of global finance - New York. New York City and finance just go together, and despite many pretenders to the throne, it remains undefeated as the reigning champ. Silicon Valley and London may have something to say about that, but when people think about global finance centres, there’s an extremely strong likelihood that NYC is top of their list.

However, as mentioned above, companies with a degree of flexibility, a less NYC-centric approach, or satellite offices across the states can still secure incredible talent from more local hubs. Boston, Los Angeles, Austin, and Miami all have exceptional talent pools, and numerous companies are already taking advantage of them as they seek to expand or consolidate their US operations. We’ve compiled a list of the best places to find US fintech talent here: https://www.harringtonstarr.com/clients/fintech-map/

In summary, while 2024 continued to challenge the financial technology staffing sector with economic stagnation and skill shortages, the prospects for 2025 appear cautiously optimistic. Political stability and economic factors in both the UK and the USA suggest potential growth and increased business confidence. The need for technological advancement and diverse, inclusive work environments remains crucial. As we move forward, those companies that adapt to these dynamics and explore talent in varied locations like New York and other US cities, while embracing hybrid work models, will likely find themselves best positioned to thrive in the evolving landscape.

By Rob Grant, COO of Harrington Starr